TogetherAI hits $3.3B valuation, Thomson Reuters reshapes AI training, Chipotle cuts hiring time 50%

- Big Tech shifts billions to AI as recruitment automation shows early success

Today’s Briefing:

In today's newsletter:

Together AI secures major funding, signaling AI infrastructure market growth

Thomson Reuters ruling sets new precedent for AI training data

Chipotle demonstrates successful large-scale AI recruitment

Big Tech's strategic shift toward AI investments

Market Impact: What these changes mean for your business

Trend Spotlight: AI Recruitment Revolution

Sponsored by*

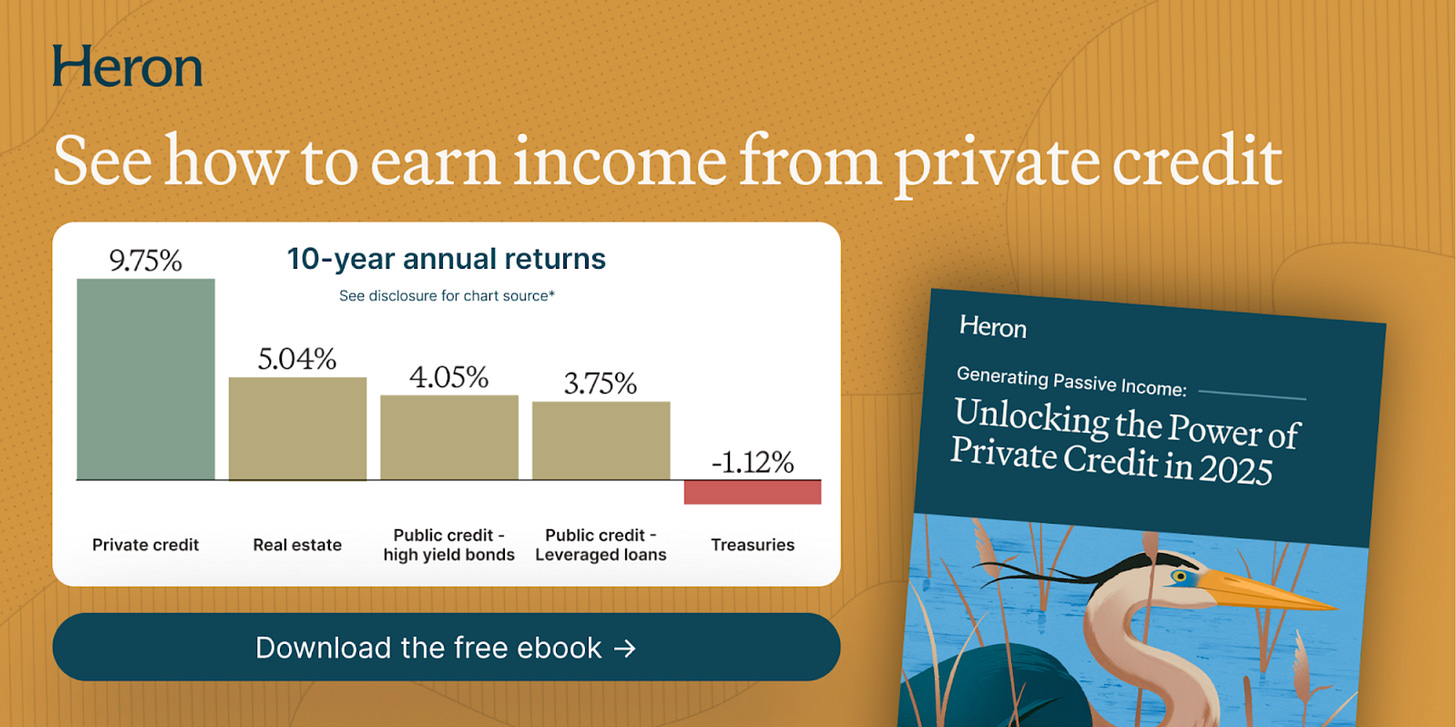

Private credit has quietly become one of the fastest-growing asset classes according to McKinsey & Co. And it’s not stopping, with the largest pension funds increasing allocations by over 50%. Why? Higher yields (often 10%+) and lower volatility than traditional income-generating assets.*

Heron Finance’s free ebook breaks down:

Private Credit Strategies: The pros and cons of different approaches.

Finding the Right Fit: Which private credit assets align with your investing style?

Portfolio Allocation: How much should you invest in private credit?

No email required—just click for insights on how private credit can diversify your portfolio and generate passive income.

Would you like to sponsor this newsletter? View our sponsorship options

Major Funding

Together AI Raises $305M, Highlighting Infrastructure Opportunity

Together AI has secured a landmark $305 million funding round led by General Catalyst, with participation from Salesforce Ventures, Nvidia, and Coatue, reaching a $3.3 billion valuation. The cloud platform now serves over 450,000AI developers and supports more than 200 open-source models, delivering 30% better performance compared to traditional cloud solutions for AI workloads.

Potential Impact This funding signals a significant shift in the AI infrastructure landscape, with growing demand for specialized platforms that can optimize deployment costs while maintaining performance. The involvement of industry leaders suggests an emerging ecosystem of AI infrastructure providers that could reshape how companies access and deploy AI resources.

First-mover Opportunities Companies can position themselves as integration specialists or develop industry-specific AI deployment solutions. Early movers in sectors like healthcare, finance, and manufacturing can create specialized platforms that bridge the gap between general-purpose AI infrastructure and industry-specific needs.

Sources ~ Reuters Additional Coverage: TechCrunch

Legal Precedent

Thomson Reuters Victory Reshapes AI Training Landscape

Thomson Reuters has won a landmark ruling against Ross Intelligence in the U.S. District Court, establishing crucial precedents for protecting proprietary data in AI development. The court's rejection of "fair use" claims has immediate implications for how companies approach AI training data acquisition and model development practices.

Potential Impact This ruling will fundamentally change how companies approach AI development, potentially increasing costs and complexity for AI training. Enterprises must now reassess their data sourcing strategies and implement robust compliance frameworks.

First-mover Opportunities Early movers can develop compliance verification tools, create marketplaces for properly licensed training data, and offer consulting services to help companies navigate the new legal landscape. Startups focusing on synthetic data generation and privacy-preserving AI training methods are particularly well-positioned.

Sources ~ El País Legal Analysis: Law360

Innovation Spotlight

Chipotle's AI Recruitment Success Opens New Market

Chipotle in partnership with Paradox has revolutionized their hiring process with AI assistant "Ava Cado," cutting time-to-hire from 8 to 4 days while achieving a 100% increase in application completion rates. The system aims to hire 20,000 employees for the upcoming peak season.

Potential Impact This successful implementation demonstrates the viability of AI-powered recruitment at scale, potentially transforming how service industry companies approach hiring. The system's success could accelerate adoption across other sectors, creating new standards for automated recruitment.

First-mover Opportunities Companies can develop specialized recruitment solutions for specific industries, create AI-powered candidate assessment tools, or build integration platforms that connect existing HR systems with new AI capabilities. The SMB market remains particularly underserved.

Sources ~ NY Post HR Tech Analysis: SHRM

Strategic Shift

Big Tech's AI Transformation Creates Opportunities

Amazon and Meta's strategic cost reductions to fund AI investments signal a fundamental shift in how tech giants approach resource allocation. Amazon's retail division is leading this transformation, balancing traditional operation cuts with increased investment in AI and robotics development.

Potential Impact This restructuring could create a ripple effect across the tech industry, as companies realign their resources toward AI initiatives. The shift may lead to increased availability of experienced talent and new opportunities for startups in the AI transformation space.

First-mover Opportunities Companies can establish AI transformation consulting practices, develop training programs for transitioning tech workers, or create tools to help enterprises manage their AI adoption journey. There's also an opportunity to acquire experienced talent for AI-focused initiatives.

Source ~ Business Insider

Market Impact Analysis

Today's developments reveal three critical shifts in the AI landscape:

Infrastructure Evolution: The Together AI funding demonstrates strong investor confidence in specialized AI infrastructure, suggesting a market moving beyond generic cloud solutions toward industry-specific platforms.

Regulatory Maturation: The Thomson Reuters ruling signals the beginning of a more structured framework for AI development, creating immediate opportunities in compliance and data governance.

Enterprise Transformation: Big Tech's strategic shifts indicate a broader market movement toward AI-first operations, creating opportunities for companies that can facilitate this transition.

These changes are creating immediate opportunities for startups and agencies to establish leadership positions in emerging market segments.

Trend Spotlight: The AI Recruitment Revolution

The transformation of recruitment through AI represents a fundamental shift in how companies approach hiring and talent management.

Market Analysis: Current market size: $5.2B (2024) Projected growth: $400B by 2026 Enterprise adoption: 43% of Fortune 500 companies

Performance Metrics:

50% reduction in hiring time

100% increase in application completion

85% candidate satisfaction with AI interactions

35% reduction in hiring costs

The most promising opportunities lie in developing solutions for underserved markets, particularly mid-sized businesses that need enterprise-grade capabilities at accessible price points.

Strategic Developments To Watch

Key Events This Week:

Nvidia's Q4 earnings report (February 26) will provide insights into AI infrastructure costs and availability

Amazon's GenAI-powered Alexa launch (February 26) could open new opportunities for developers

Expected DeepSeek funding announcement may reveal new partnership opportunities

Tomorrow's Focus: We're monitoring potential industry responses to the Thomson Reuters ruling and developments in the EU AI regulatory framework. Expect announcements from major AI companies about their data sourcing strategies.

Question for Business Leaders: What manual processes in your business could benefit most from AI automation?

Get Involved

Submit news or Share insights: hello@futureweb.vc

Sponsor

Would you like to sponsor this newsletter? View our sponsorship options

*Disclosure: This is a paid advertisement. The opinions expressed in this advertisement are strictly those of Heron Finance. The information in this advertisement does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information contained in this advertisement is a recommendation to invest in any securities. Please note there are no material conflicts of interest related to this advertisement. Returns are not a guarantee of future results. Please consider all risk factors before investing. Information sourced from McKinsey & Company (September 24, 2024) and Pensions&Investments (February 4, 2025). Chart Disclosure: Based on last 10-year annualized total returns as of December 31, 2024. Funds used to represent asset classes include: VanEck BDC Income ETF (BIZD), Vanguard Real Estate Index Fund ETF (VNQ), iShares iBoxx $ High Yield Corporate Bond ETF (HYG), Invesco Senior Loan ETF (BKLN), and iShares 20+ Year Treasury Bond ETF (TLT). Past performance does not guarantee future results.