OpenAI investing $12B into CoreWeave in strategic move against Microsoft

While others read about AI news, you'll know exactly what to do about it

Today’s Briefing:

In today's newsletter:

DOJ drops bid to make Google sell AI investments

Chinese firm Manus claims to develop first general AI agent

ServiceNow announces acquisition of AI company Moveworks

Foxconn builds 'FoxBrain', its own AI model for improved operations

You.com CEO predicts decline of Google's search monopoly

Sponsored by*

It's been said that investing legend, Warren Buffet's, #1 rule is: “Don’t lose money.”

And if you don’t want to lose money, investing in private credit might just be able to help, especially in a volatile market.

Here's why…

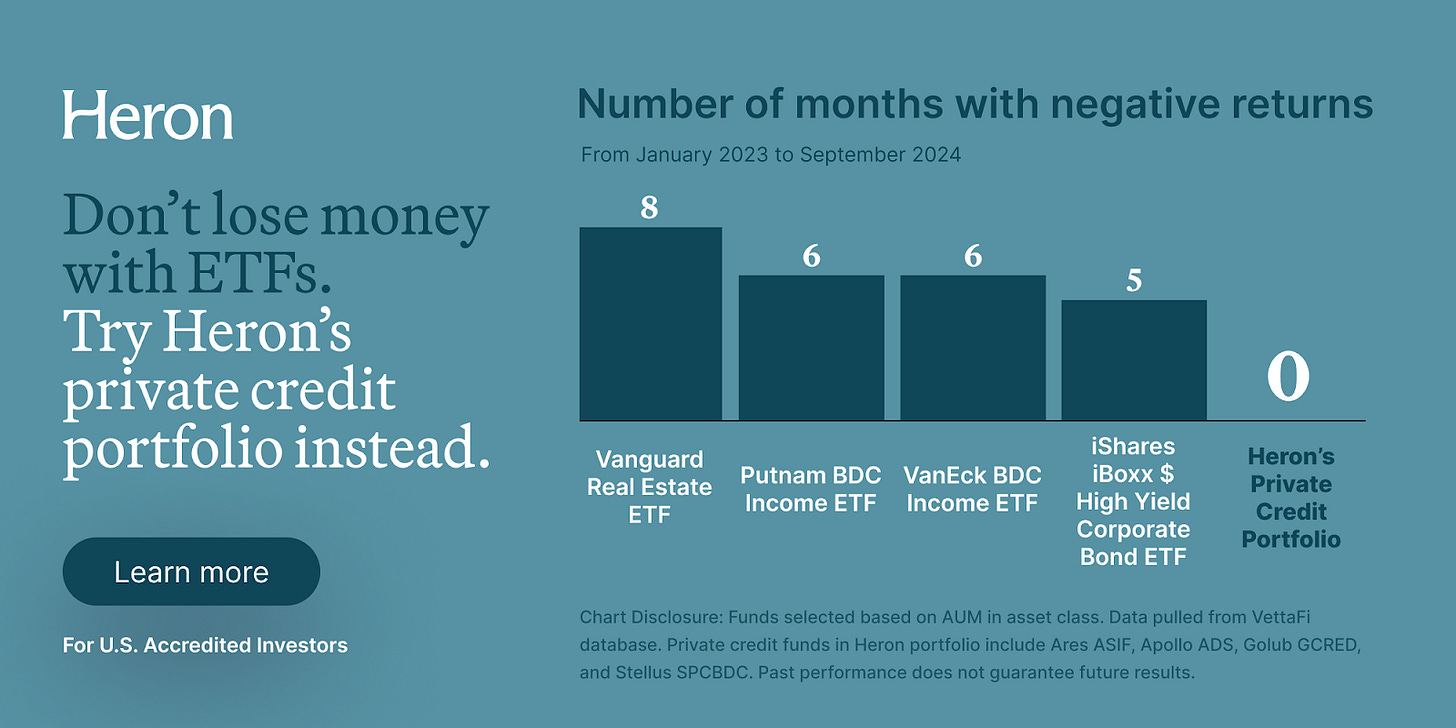

Heron Finance’s private credit portfolio has had 0 down months since the start of 2023.* Not many assets can say that.

In fact, since January 2023, the largest high-yield bond and real estate ETFs all suffered from five or more down months. Although past performance does not guarantee future returns, for investors looking for stable passive income, Heron’s Personalized Private Credit portfolio delivers consistent returns.

How does Heron do it?

Heron builds you a personalized portfolio with exposure to the world’s largest private credit funds from Ares, Apollo, and more – targeting up to 11% yield after fees.*

And when it comes to fees, Heron gives investors access to the lowest share class for all of the funds on its platform, which in most cases saves you 0.85% annually compared to directly investing in funds.

Would you like to sponsor this newsletter? View our sponsorship options

Markets

Search & Discovery

You.com CEO predicts decline of Google's search monopoly - Richard Socher forecasts AI-driven search alternatives will erode Google's market dominance. Read more

Startup & Funding

OpenAI investing $12B into CoreWeave in strategic move against Microsoft - OpenAI makes major infrastructure play by pouring billions into Nvidia-backed AI cloud provider. Read more

Legal & Governance

DOJ drops bid to make Google sell AI investments - Justice Department modifies antitrust demands, allowing Google to keep AI stakes while still pushing for Chrome divestiture. Read more

Judge allows authors' AI copyright lawsuit against Meta to proceed - Sarah Silverman's lawsuit claiming Meta used copyrighted books to train AI models advances to trial. Read more

Scale AI signs DOD contract for "Thunderforge" - AI company secures multimillion-dollar defense contract for operational planning AI agents. Read more

Corporate Development

Apple delays Siri AI upgrades to 2026 - Co-designer blames company's perfectionism as Siri enhancements fall behind competing AI assistants. Read more

ServiceNow to acquire Moveworks - ServiceNow announces plans to acquire AI company Moveworks. Read more

Foxconn builds 'FoxBrain', its own AI model - Electronics manufacturing giant develops proprietary AI capabilities. Read more

US DOJ won't force Google to divest AI investments - Department of Justice modifies demands in ongoing antitrust case. Read more

Chinese firm Manus claims to develop first general AI agent - Company announces development of autonomous AI system capable of complex reasoning. Read more

Analysis

Today's news highlights several significant developments reshaping the AI landscape:

Regulatory Pragmatism

The DOJ's decision not to force Google to divest its AI investments while still pursuing Chrome divestiture reveals a nuanced regulatory approach (Read more). Regulators appear to be distinguishing between Google's established browser monopoly and its emerging AI ventures. This suggests a recognition that overly restrictive measures in the rapidly evolving AI space could hamper innovation, while still addressing competition concerns in mature markets.

East-West AI Competition Intensifies

Chinese firm Manus's claim of developing the first general AI agent capable of complex reasoning represents a potential milestone in international AI competition (Read more). If verified, this development could challenge Western companies' perceived leadership in advanced AI systems. Coming amid ongoing tensions over technology transfer and export controls, this announcement may accelerate both development efforts and regulatory responses in the US and Europe.

Corporate AI Strategy Divergence

Today's news reveals contrasting approaches to AI development among major tech players. Foxconn's development of 'FoxBrain' represents an in-house approach focused on operational efficiency and business diversification (Read more). ServiceNow's acquisition of Moveworks demonstrates a strategy of buying rather than building specialized AI capabilities (Read more). Meanwhile, Apple's delay of Siri upgrades until 2026 suggests some companies may be taking a more deliberate, perfectionist approach despite competitive pressures.

Search Disruption Gathering Momentum

You.com CEO's prediction about the decline of Google's search monopoly (Read more) points to growing momentum behind AI-driven alternatives to traditional search. This development suggests we're approaching an inflection point where conversational, contextually-aware AI interfaces may begin to seriously challenge the traditional keyword-based search paradigm that has dominated for decades.

Enterprise AI Integration Acceleration

ServiceNow's acquisition of Moveworks specifically to enhance workflow automation capabilities (Read more) highlights the accelerating integration of AI into enterprise software platforms. Rather than treating AI as a separate tool or add-on, companies are increasingly embedding AI capabilities directly into core business processes, suggesting the next phase of enterprise AI adoption is well underway.

These developments collectively point to a maturing AI ecosystem where strategic differentiation, specialized applications, and integration into existing products and services are becoming more important than general technical capabilities alone.

Get Involved

Submit news or Share insights: hello@futureweb.vc

Sponsor

Would you like to sponsor this newsletter? View our sponsorship options

*Disclosure: This is a paid advertisement. The opinions expressed in this advertisement are strictly those of Heron Finance. The information in this advertisement does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information contained in this advertisement is a recommendation to invest in any securities. Please note there are no material conflicts of interest related to this advertisement. 12% based on the Aggressive portfolio. Any investment target interest rate presented here is intended for informational purposes only and does not guarantee future performance results. This model assumes no variability, including no loan defaults, no fluctuation in interest rate, no customer withdrawal requests, no late payments, and unchanged management fees throughout this projection. Please be aware that all investments involve inherent risks. Customers are advised to consult their own legal and tax advisers before investing. Returns are not a guarantee of future results. Please consider all risk factors before investing.